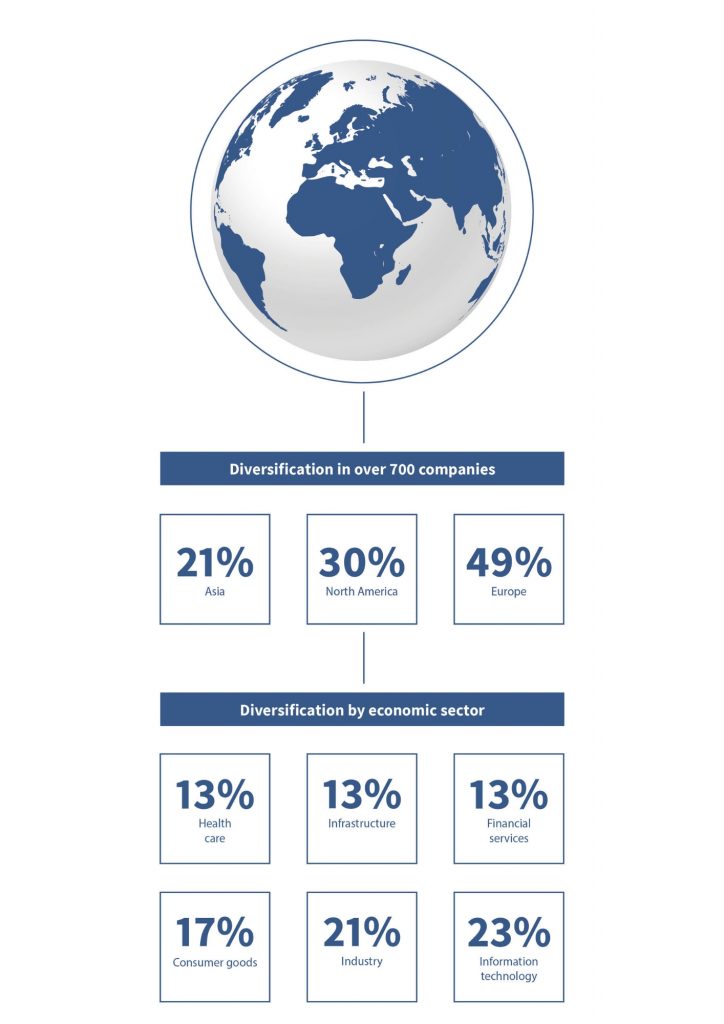

We have systematically invested in growing as well as established companies in recent years. We have entered into a total of more than 700 shareholdings – mainly as silent participations in companies of different sizes. We are active in all national and international markets, analysing growth markets and growth industries and their larger settings. We tailor our investment styles to the framework conditions and apply a very wide variety of investment styles to make use of the most promising opportunities. Whether venture, growth or buyout – we approach every investment strategically, guided by our diversification philosophy.